The financial services industry has changed significantly over the past years, and technology has been at the heart of that change. Heightened competition and rapid progress in disruptive technologies have brought about a paradigm shift in the banking experience which has accelerated in 2018.

Banks that don’t invest in technology risk falling behind, as new regulation continues to level the playing field with new innovative players. Last year, many of the banks appealed to the CMA for an extension for the Open Banking initiative. A number of banks are reaching the end of their extension period which obliges them to give banking customers more control over their financial data by allowing them to share it with challenger banks and fintech firms.

The introduction of the open banking initiative across Europe opens the floodgates to competition – As PSD2 balances the scales between banks and digital players, banks are directing resources towards digitally transforming their operations and services.

Lloyds Banking Group recently launched a £3bn investment in a three-year strategy to strengthen its digital capabilities. It aims to slash costs to less than £8bn by 2020 and transform the banking experience for their end-customers. The bank is driving capital towards technology and its staff to compete against mounting pressure from other traditional banks, challenger banks and fintechs.

Talent and human capital provide the best value and return on investment for banks looking to diversify their digital offerings. Investment in talent and digital skills goes hand-in-hand with investment in technology solutions to help banks become more fluid and responsive to changing customer behaviours.

In a world where everything is accessible at the click of a button, customer expectations need to be matched by the experiences created by banks. Earlier this year, USB found that online banking has overtaken visiting branches for the first time. The study found 52 per cent of all consumer transactions are now done online, making it the primary method of banking

Bank branches are expensive with most retail bank branches costing banks between 40-60 per cent of total operating costs. The cost savings from a reduced number of branches can be redirected towards investments into creating digital banking experiences that accommodate evolving customer habits.

With introduction of new financial technologies, the way in which people manage their money has shifted dramatically. However, the current potential of the UK financial services industry is restricted by the lack of tech and digital talent available. Firms are spending record amounts, with 85 percent of business executives allocating up to a quarter of their total budget to digital transformation in 2018.

Digital Transformation goes beyond moving traditional banking to a digital world. A digital strategy is no longer limited to the IT department. In the current business environment, it transcends every aspect of a business and drives long-term success. In order to digitally transform, banks need to adopt a digital mind-set. This means fostering a culture of innovation. It’s about going beyond the hype of digital trends and the latest buzz words and identifying the business impact on operations and service delivery.

Most banks still run on core systems installed in the 1970s and 1980s. These enterprise structure are made up of a patchwork of systems with limited functionality for the current digital landscape. Fintech and challenger banks are not hindered by these systems, and have the agility to keep pace with customer expectations, which means banks are turning their attention to their business critical function and how they can re-engineer it to become more flexible.

Smart banks are taking advantage of cloud-based systems to enable staff to better communicate and interact with customers across multiple channels to accommodate all customers.

Banks definitely need to push forward with their digital strategy, but they must do so wisely, supported by a reliable digital partner. Technology is beginning to encompass all aspects of bank operations. Working with a single-source supplier that integrates digital into the DNA of the bank – from the talent to the technology solutions – is key to adopting a digital mind-set, which will support a bank’s digital transformation journey end-to-end.

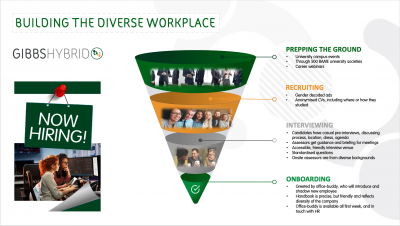

About Gibbs Hybrid

Gibbs Hybrid offers a single source integrated solution with programme consultancy, talent, technology and outsourcing initiatives that drive customer success.

Gibbs Hybrid’s single source philosophy means that our three lines of business – talent management, programme technology solutions and outsourcing can integrate with each other, creating Hybrid capabilities, or stand alone as best-of-breed solutions.

Offering this flexibility allows clients to engage with a single preferred partner for multiple services, thus addressing challenges of supplier rationalisation or vendor consolidation. Our service management approach helps to ensure that our quality remains high without compromising speed to market.

We serve mid-market and Fortune 500 companies globally. Since its establishment in 2005, Gibbs Hybrid has grown to over $100 million in annual revenue with more than 700 employees, associates and consultants. We are headquartered in UK with offices in Ireland, Poland, Luxembourg, US and Canada.